Benefits of Investing in Your Health

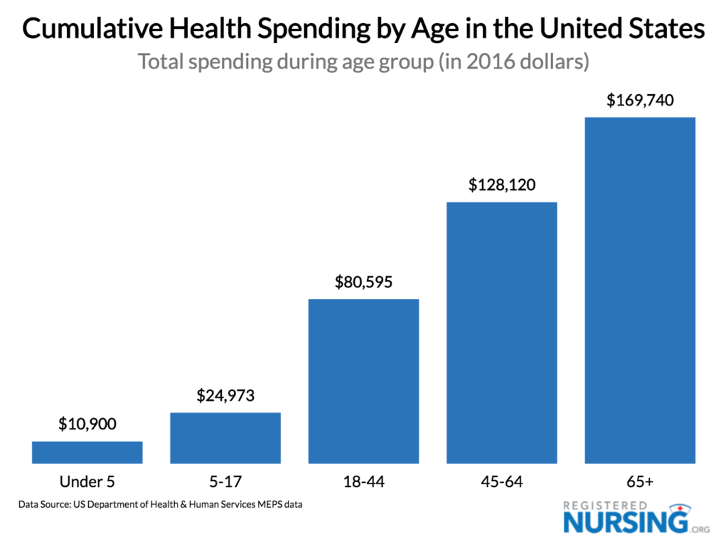

When it comes to the cost of healthcare, you might be shocked to know the amount an average, relatively healthy person will spend on care over the course of their lifetime.

Healthcare costs tend to mount as we age. We require more screenings and preventative care, some of us need home health care or other more expensive assistance, and many of us will eventually experience declines in vision, hearing, and mobility that will require supportive devices like glasses, hearing aids, walkers, and wheelchairs.

When you consider all of the care, things, and time you’ll need in your later years, it’s easy to make the case for investing well in your health today.

The Real Costs of Healthcare

For those who are considered relatively healthy, the idea of saving for healthcare-related costs probably doesn’t seem very pressing. It can be challenging to convince people that they should spend their money on something they can’t imagine actually needing in the very distant future—until you see the numbers.

The average person will spend nearly $170,000 dollars on standard medical expenses in their lifetime, with the largest proportion of this investment being made after they turn 65. As we grow older, the odds increase that we will eventually need care for a chronic illness, major accidents, or other diseases that require costly treatments and medications like cancer.

When you consider the fact that older age often brings the need for living assistance, whether it’s at home or in a facility, the financial burden continues to grow.

Long Term Care: An Age Related Expense

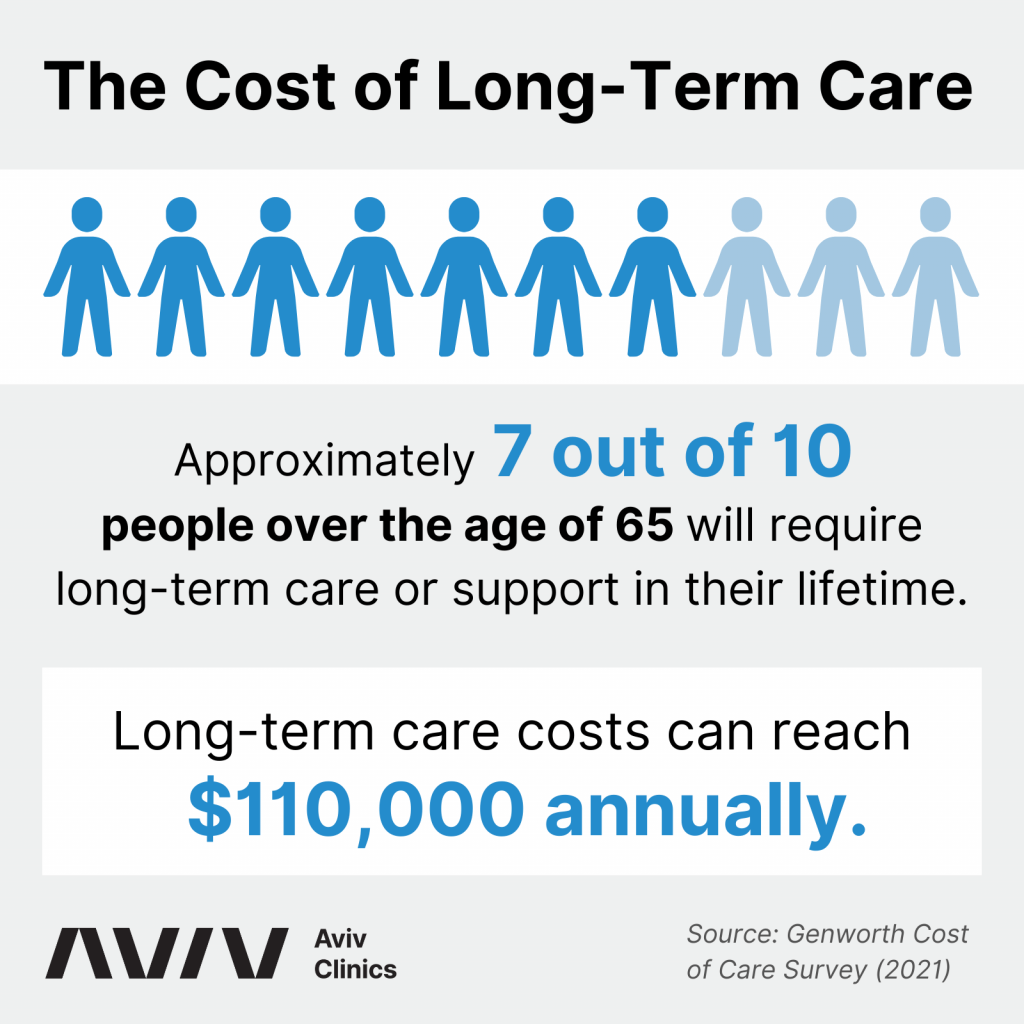

Long-term care, including home health aides, homemaker care, assisted living or nursing and rehabilitation facilities can be a costly and often unanticipated expense.

Although some people need long term care because of an accident or illness, the majority of those who require long-term assistance do so because of age-related conditions. Close to 70% of retirement-age Americans will require long-term care or support at some point.

Depending on the level of care needed, long-term care can cost up to $110,000 annually:

- Adult day care (40 hours/week): $18,000-$22,000 per year

- In-home care (homemaker or home health, 40 hours/week): $55,000-$66,000 per year

- Assisted living: $52,000-$66,000 per year

- Nursing home care: $102,000-$110,000 per year

Because long-term care is not typically covered by Medicare or other health insurance programs, it is generally paid out-of-pocket, either by dipping into retirement savings or paid by the spouses or children of those who need care.

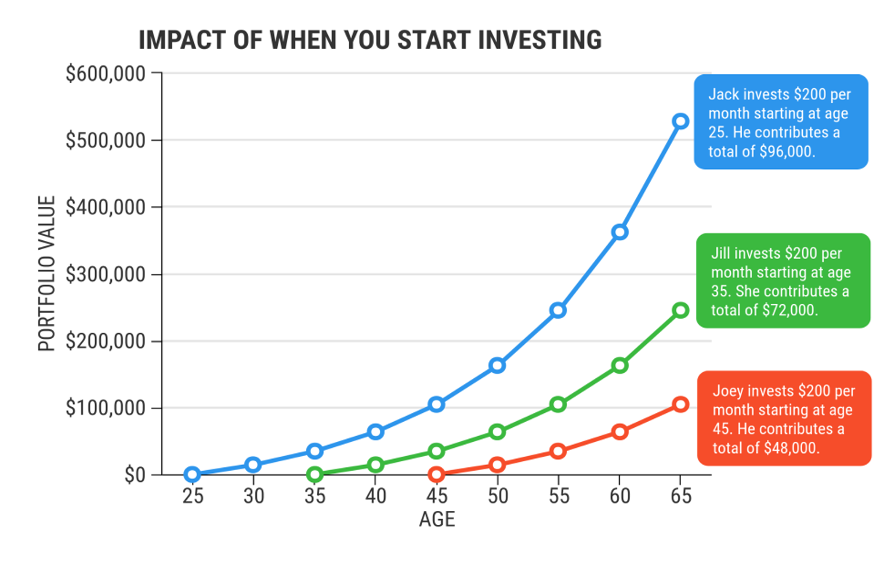

Similar to retirement investing, those wanting to have a comfortable existence in their retirement years will need to begin saving to cover these costs, the earlier the better, of course.

Those who begin saving when they’re in their 20s, will be much better prepared to shoulder the burden than others who delay investing until their 30s or 40s, or late.

The Costs to Our Caregivers

Often, when we become ill or frail, our caregiving responsibilities rest on the shoulders of our loved ones. While this sometimes occurs because of a lack of financial resources for paid care, other people decline paid care because they want to leave an inheritance to their heirs.

While the idea of leaving a legacy for our family is noble, the cost of relying on our loved ones for age-related care can far outweigh the financial benefit.

About 1 in 6 Americans (41.8 million) are unpaid caregivers to someone aged 50 or older, and that number is expected to increase as life expectancy grows. For these individuals, the physical and emotional strain of caregiving can have significant detrimental physical and mental health impacts:

- The mortality rate for family caregivers is 63% higher than non-caregivers their age.

- 36% say caregiving is highly stressful

- 23% say caregiving has made their health worse

- 21% say their health is fair or poor (compared to 12% of the general population)

- 17% experience high physical strain

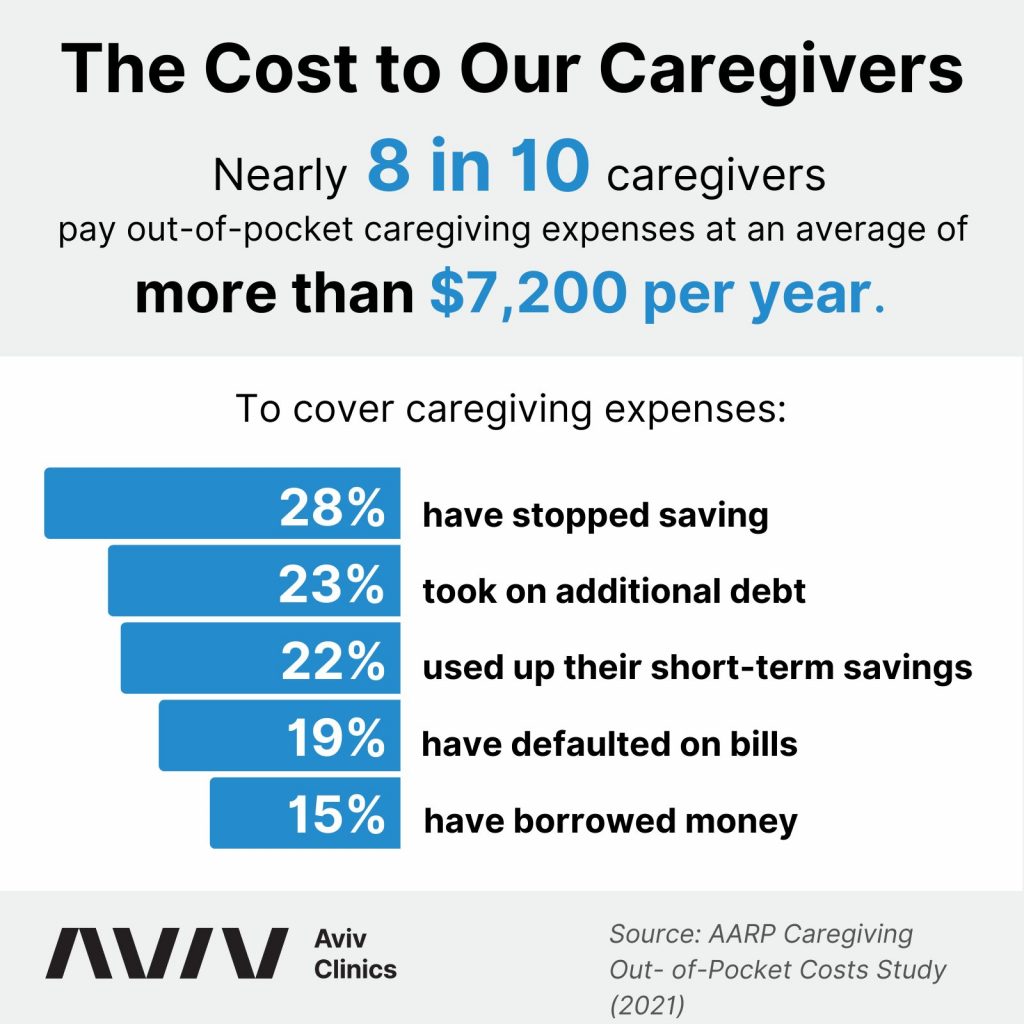

Caregiving can also create a significant financial burden on our loved ones. An AARP study revealed that 78% of family caregivers pay an average of $7,242 every year in out-of-pocket caregiving expenses.

Because of the time commitment required to provide care, family caregivers also collectively lose an estimated $522 billion in wages each year. According to the same study, caregivers experience numerous other detrimental effects in the workplace. Because of their caregiving responsibilities:

- 15% reduced their work hours

- 14% took one or more leaves of absence

- 8% have been warned by a supervisor about their attendance or performance

- 7% turned down promotions

- 6% gave up working entirely

- 5% retired early

- 4% lost some or all of their benefits

The Beyond the Bank Account

When we think about investing in our health, finances are just one part of the equation.

Having the money to cover your health-related expenses as they arise is important and certainly relevant, but what if you could minimize these expenses or help you avoid incurring them in the first place?

An investment in a healthy, active lifestyle will pay dividends in the form of a lengthier lifespan, but also in a more positive healthspan.

The two often go hand in hand, but whereas lifespan just tells us how many birthdays you’ve celebrated, healthspan is a more meaningful marker that tells us more about the quality of those years. It is towards the end of your lifespan that your healthspan can begin to suffer the consequences of your choices earlier on.

Time and effort invested in caring for your mind and body by making positive lifestyle choices while you’re young is as important an investment in your health as setting aside money to cover future costs.

What You Can Do Today to Invest in Your Health Tomorrow

There are countless opportunities to invest into your health right now and most of them just require simple adjustments to your lifestyle and priorities.

1. Start Saving Early

As previously mentioned, that the average American will spend upwards of $170,000 on their healthcare. This is money you will need on top of personal savings and retirement benefits to cover your basic living expenses.

Just as you might talk to your financial advisor about how to make the best retirement plan investments, be sure you also ask them to factor in healthcare expenses in a realistic way.

2. Eat Healthy and Exercise

We’ve all heard how important diet and exercise are for your overall health and wellness. Eating a healthy, balanced diet and getting the recommended amount of weekly movement is an investment of time and effort we can all benefit from making.

Obesity, Type 2 diabetes, and hypertension can all have major impacts on both your lifespan and your healthspan. These conditions are some of the leading causes of death for adults in America. Treating and controlling them greatly impacts your healthspan.

The good thing is that many of these conditions are also preventable by keeping a healthy diet and committing to adequate exercise.

Make eating healthy and fitting in fitness a priority in your life. The sooner you commit to a healthy lifestyle, the longer you’ll be able to stave off costly health care that takes years and quality away from your life.

3. Practice Proper Sleep Hygiene

The importance of sleep as a form of healthcare is so often overlooked. Sleep is essential to every function of the body, helping us maintain mental acuity, perform physical tasks effectively, engage socially with our family and friends, and even fight off infections to stay healthy.

Without adequate sleep your brain can’t function properly and your body suffers. Chronic sleep deprivation has been linked to a higher risk for certain diseases and medical conditions including obesity, type 2 diabetes, high blood pressure, heart disease, stroke, poor mental health, and even early death.

Work on implementing healthy sleep habits into your lifestyle. To get started, consider doing the following:

- Create a comfortable sleep environment: light, sound, temperature and mattress.

- Implement a relaxing bedtime routine.

- Put down your electronic devices at least 30 minutes before bedtime.

- Avoid large meals and caffeine in the hours leading up to bedtime.

- Make time for exercise during the day.

4. Learn to Manage Stress Appropriately

Stress can play a major role in your health and wellness. The physical and mental impact of stress can lead to a variety of health issues including chronic headaches, elevated blood pressure, chest pain and other heart problems, gastrointestinal issues, diabetes, asthma, and more.

While there’s no way to eliminate stress from your life entirely, learning to manage it appropriately can help mitigate the impact it has on both your lifespan and your healthspan.

Spending time with friends and family, exercising, meditation or prayer, and pursuing a favorite hobby can all help alleviate stress.

The Case for a Major Investment

We often choose to make major investments in our lives because the long-term results have a positive effect on our quality of life. Purchasing a home, contributing to a retirement savings account, and paying for higher education are all examples of major investments we hope will provide major benefits.

Investing in the Aviv Medical Program is a long-term investment in your health that will pay dividends for years to come. Our protocol strengthens your healthspan, essentially adding several years to the life of your cells and thus, your body.

Just as a financial advisor would consider your entire financial history and portfolio to determine the best course for investing, at Aviv Clinics, we take into consideration your entire health history—your cognitive function, your physical performance, your body composition, your genetics, your lifestyle—and this information is used to create a customized treatment program just for you.

As your cells experience this level of healing and new growth, so too will your lifespan and healthspan.

Bottom Line

When it comes to investing in your health, the return on investment is higher the earlier you invest. Making the effort to eat healthily, increase your exercise, get quality sleep, and manage your stress will give you a chance to enjoy a higher quality healthspan and a longer life.

Contact us to learn more about how you can invest in your health to extend your healthspan with the Aviv Medical Program.